SIP- Systematic Investment Plan

> What is SIP?

> Why to Invest?

> How to Start Investing

> Compounding

Tips before Investing

> Its Never too late to start - Invest as early as possible to get Huge Returns

> Slow and Steady wins the race - Like the Hare- Tortoise story, Be patient and wait to enjoy seeing your Money Grow

> Consistently, Investing for long term activates compounding effect

A SIP (Systematic Investment Plan) is a perfect method for investing in the mutual funds. It enables the investor to invest in standard interims. It is an arranged method for investing, which develops the propensity for reserve funds and achieve the objective of riches age.

Under SIP, one can invest on a quarterly, month to month or week by week premise according to their benefit. A fixed sum is auto-charged from the policyholder's record and invested in mutual funds. A pre-chosen number of units are allotted at the present market cost. Since these plans are adaptable in nature, the investors can expand the sum or end investing in the arrangement at whatever point they wish to.

Five reasons to invest via SIP

- A disciplined approach to investing

One of the significant advantages of investing by means of SIPs is that they help in developing the investing propensity.

As you need to invest a fixed sum month to month, you build up the propensity for normal investing over some stretch of time.

Helps in financing

The dominant part of the general population invests in SIPs with long haul objectives like purchasing a house, youngsters' training, retirement and so on.

As it is hard to hack up such colossal sums in one go, it bodes well to manufacture a corpus over some undefined time frame by making customary month to month investments.

Minimize the risk of equity fluctuations

As investing through SIPs includes making an occasional investment in the values through value mutual fund, you're ready to ride through the good and bad times of values without hardly lifting a finger.

At the point when the market goes up, you gain fewer units and when it falls, you get more units. Resultantly, as you keep making investments over some undefined time frame (paying little respect to the market circumstances), timing the market winds up superfluous.

Diversification

The customary way of thinking says that it is never a smart thought to keep all your investments tied up in one place! It is even more appropriate for the investment area. Most specialists urge investors to purchase blue-chip stocks and differentiate them crosswise over somewhere around eight to ten divisions.

A noteworthy favorable position of investing in mutual funds by means of SIPs is that one gets the chance to appreciate the advantages of broadening even with little investments. Thus, the risk gets spread out and you capitalize on the additions from various possessions.

Most of the compounding

Investing in SIPs yields better returns as you remain invested for a longer timeframe and thus intensifying is effectively the greatest preferred standpoint.

The prior you begin investing with SIPs, the better it is. Regardless of whether you spare Rs. 500 or 1000 every month, your investment mixes over the longer term and gives you leverage for riches creation.

- Set your financial objectives

- Set a course of events

- Choose the amount you have to invest

- Settle on a decision

- Presently you are good to go

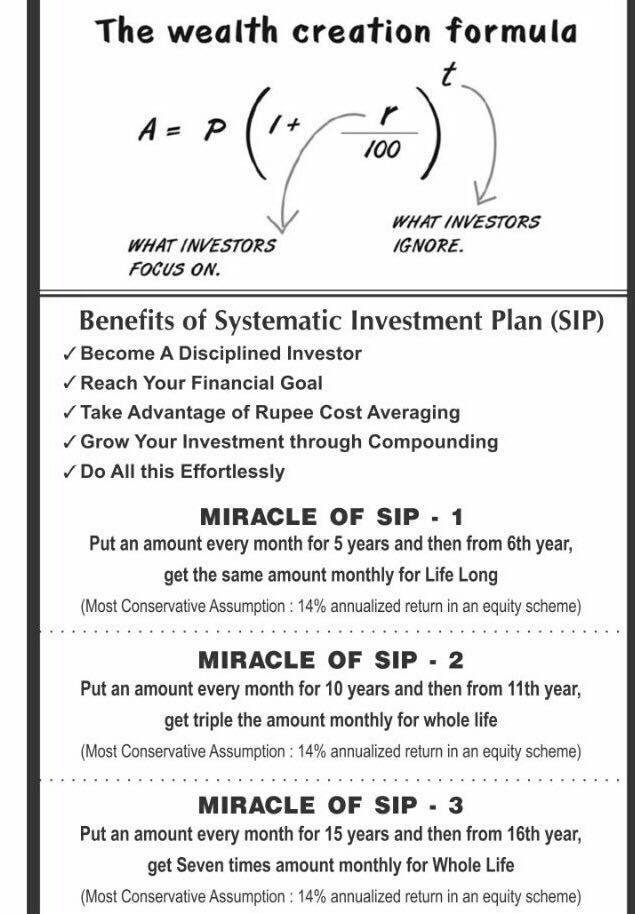

Compounding is the process of generating more return on an asset's reinvested earnings. To work, it requires two things: the reinvestment of earnings and time. Compound interest can help your initial investment grow exponentially. For younger investors, it is the greatest investing tool possible, and the #1 argument for starting as early as possible. Below we give a couple of examples of compound interest. By Investopedia

The Power of Compounding

Compounding of interest is earning interest on the initial investment and on the accumulated amount of interest of the previous periods.

In Short! Earning interest on interest.

Albert Einstein considered compounding to be the 8th wonder of the world.

Thanks to stayinvested for the calculation.

5 Lakhs at 10% Compounding

| Years | Interest Rate | Amount | Amount in words (Rounded) |

|---|---|---|---|

| 0 | 10% | 5,00,000 | 5 Lakhs |

| 5 | 10% | 8,05,255 | 8 Lakhs |

| 10 | 10% | 12,96,871 | 13 Lakhs |

| 20 | 10% | 33,63,749 | 34 Lakhs |

| 30 | 10% | 87,24,701 | 87 Lakhs |

| 40 | 10% | 2,26,29,627 | 2 Crores 26 Lakhs |

5 Lakhs at 16% Compounding

The BSE Sensex has figured out how to give a 16% CAGR throughout the most recent 38 years

| Years | Interest Rate | Amount | Amount in words (Rounded) |

|---|---|---|---|

| 0 | 16 | 5,00,000 | 5 Lakhs |

| 5 | 16 | 10,50,170 | 10 Lakhs |

| 10 | 16 | 22,05,717 | 22 Lakhs |

| 20 | 16 | 97,30,379 | 97 Lakhs |

| 30 | 16 | 4,29,24,938 | 4 Crores 29 Lakhs |

| 40 | 16 | 18,93,60,579 | 19 Crores |

5 Lakhs at 20% Compounding

Warren Buffett as indicated by his letter to shareholders oversaw around 20% return by and large aggravated every year. This 20% aggravated more than 60 years, it brought him from a couple of million dollars to top 3 most extravagant individual on earth

| Years | Interest Rate | Amount | Amount in words (Rounded) |

|---|---|---|---|

| 0 | 20 | 5,00,000 | 5 Lakhs |

| 5 | 20 | 12,44,160 | 12 Lakhs |

| 10 | 20 | 30,95,868 | 31 Lakhs |

| 20 | 20 | 1,91,68,799 | 1 Crore 91 Lakhs |

| 30 | 20 | 11,86,88,156 | 12 Crores |

| 40 | 20 | 73,48,85,783 | 73 Crores |

5 Lakhs at 25% Compounding

| Years | Interest Rate | Amount | Amount in words (Rounded) |

|---|---|---|---|

| 0 | 25 | 5,00,000 | 5 Lakhs |

| 5 | 25 | 15,25,878 | 15 Lakhs |

| 10 | 25 | 46,56,612 | 47 Lakhs |

| 20 | 25 | 4,33,68,086 | 4 Crores 68 Lakhs |

| 30 | 25 | 40,38,96,783 | 40 Crores |

| 40 | 25 | 376,15,81,922 | 376 Crores |

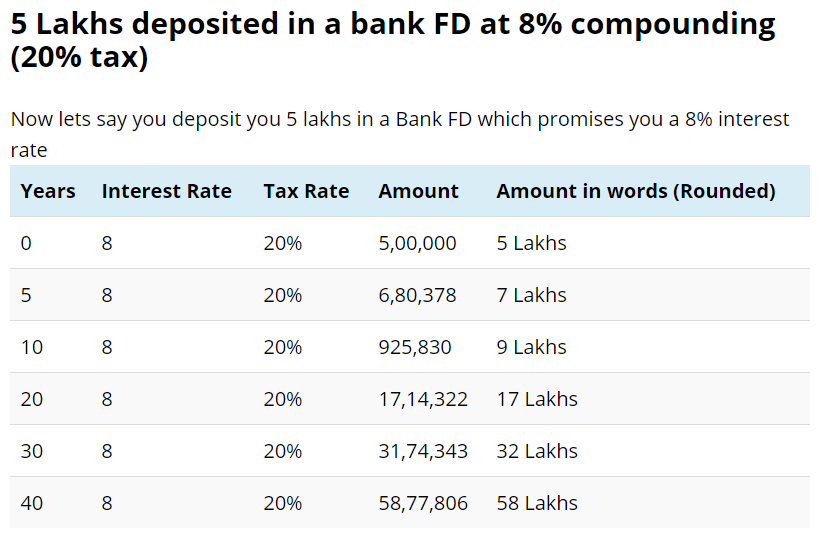

5 Lakhs deposited in a bank FD at 8% compounding (20% tax)

5 lakhs in a Bank FD at promised 8% interest rate

| Years | Interest Rate | Tax Rate | Amount | Amount in words (Rounded) |

|---|---|---|---|---|

| 0 | 8 | 20% | 5,00,000 | 5 Lakhs |

| 5 | 8 | 20% | 6,80,378 | 7 Lakhs |

| 10 | 8 | 20% | 925,830 | 9 Lakhs |

| 20 | 8 | 20% | 17,14,322 | 17 Lakhs |

| 30 | 8 | 20% | 31,74,343 | 32 Lakhs |

| 40 | 8 | 20% | 58,77,806 | 58 Lakhs |

5 Lakhs deposited in a bank FD at 8% compounding (30% tax)

5 lakhs in a Bank FD at promised 8% interest rate with 30% Income tax rate

| Years | Interest Rate | Tax Rate | Amount | Amount in words (Rounded) |

|---|---|---|---|---|

| 0 | 8 | 30 | 5,00,000 | 5 Lakhs |

| 5 | 8 | 30 | 6,54,735 | 7 Lakhs |

| 10 | 8 | 30 | 8,57,355 | 9 Lakhs |

| 20 | 8 | 30 | 14,70,118 | 15 Lakhs |

| 30 | 8 | 30 | 25,20,829 | 25 Lakhs |

| 40 | 8 | 30 | 43,22,497 | 43 Lakhs |

Frequently asked questions

Pros

Cost Averaging - This is the greatest advantage of doing SIP. Through SIP you are investing at each all costs. In the event that the market is down, you are purchasing more units and when the market goes up (that is the reasons you are investing), the estimation of the investment goes up. This expels the risk of investing at the wrong time.

Can Start with Small Amount - You don't need a lot of reserve funds to begin a SIP. The vast majority of the great Mutual Funds let you begin SIP with as low as Rs 500. Check Best Mutual Funds To Invest With Rs 500: SIP

Taught investing - many individuals whine that they are not left with enough cash to invest before the month's over. With SIP, one begins investing directly in the start of the month and spends from the left cash. This gets pupil sparing and makes riches in long haul.

Recurring Investing many individuals in India are not investing a direct result of sheer lethargy or mental exertion. With computerized SIP, you need not stress over the investment consistently and it's dealt with naturally.

Cons

Cons

Average Returns - in the event that you unequivocally accept (and have a few information focuses) that the market will go up in not so distant future, investing singular amount would be superior to SIP, since SIP will average your expense.

Less control - In a way SIP is an unbending item. You are investing a fixed sum in a fixed Mutual Fund conspire. On the off chance that you need to change the plan or the sum, you have to stop the main SIP and begin a new one.

Cumbersome returns- Every month you are investing at an alternate cost. The standard returns (current value price tag) does not bode well for such investments. You have to utilize XIRR (exceed expectations) for ascertaining the returns and contrasting it against other investment choices.

The Sensex has given an approx 16% return in the course of recent years. At present, the best you may probably get from a bank or Corporate FD is 8% returns.

Let's demonstrate to you the genuine distinction in outright returns. Here comes the Power of Compounding.

Suppose you invest 5 Lakhs in any Equity Sensex Index Fund and another 5 Lakhs in a Bank FD that gives you 8% returns. How about we expect you fall in the 20% assessment section.

Value Returns

Bank FD returns

In the event that you analyze the returns of the two. Following 40 years you could make 19 Crores (or approx 16+ Crores after Long term charge) stanzas just 58 lakhs from your Bank FD. Which one will you pick?

Many people feel that the Bank is the most secure choice and thus invest all their cash in the bank FDs. Anyway, your stock market returns will, in general, be steady in the long haul (20+ year individual). Is the loss of 16 crores worth the psychological security that the bank gives you?

I didn't concentrate on the SIP part. My presumption here is that you are increasingly worried about Equity mutual funds versus Bank FDs. In spite of the fact that the model I've given accept a lumpsum investment in an Equity mutual fund the figurings and the final product are comparable in the equivalent in the event that you pick a SIP plan.

Thanks to the power of Compounding.

The most ideal approach to set aside extra cash is through opening FDs and RDs. However, Considering - The premium one acquires on an FD is about 7% to 8%. Additionally, this profit is assessable. Also, an RD offers a rate of intrigue even lower than this. Along these lines, it doesn't generally bode well to invest in a technique that scarcely beats expansion. Adequately, it implies you aren't generally acquiring any enthusiasm subsequent to putting your cash in an FD or RD.

Mutual funds then again are an investment choice that offers rewarding returns over the long haul. I state long run since it is essential to remain invested in a plan for something like 3 years to beat market unpredictability. Investors select a plan dependent on its annualized returns which may differ between 15% to 20%. Be that as it may, more significant than returns is long haul pledge to a fund.

Presently investing in mutual funds should be possible through two techniques - lumpsum or SIP. On the off chance that you have a surplus measure of money good to go, it bodes well to make a lumpsum investment. In case, you are a salaried individual, it is smarter to begin a SIP. There are a few advantages that SIPs give to investors. Your cash gets secured FDs and RDs for a particular period. Tastes are definitely more adaptable than that. You can delay a SIP on the off chance that you need funds. In addition, the premium earned through SIP isn't even assessable after the principal year.

If you are considering Mutual Funds, then Yes.

- A financial voyage must start with defining an objective.

- A great deal of us spare or Invest cash with no specific financial objective as a primary concern, and in this way pay the cost in terms of lower returns.

- A financial voyage can't be abandoned, in light of the fact that one's objectives appear to be remote, or there are challenges in transit.

- It can't be relinquished for the hardships one may need to endure amid the voyage.

- One can't venture out anticipate that objectives should be met. One must make one stride after another to in the end accomplish financial freedom.

- One's financial objectives are accomplished in the wake of making various determined strides.

- This persistent adventure can be called normal investing or efficient Investment.

- Maybe such returns may not actually rehash later on.

- Despite that, ordinary investment over a bin of blue-chip stocks, value record or mutual fund plans will undoubtedly convey great returns to investors over the long haul.

- A basic SIP (Systematic Investment Plan), where an investor invests a fixed measure of cash each month, is a tried and true method for expanding long haul returns.

- Clinging to this basic recipe enables you to keep away from anxious selling amid market alarms, something that has pushed such a large number of retail investors to the sidelines of the market for an extensive stretch of time and kept them from taking an interest in the unavoidable up turns of leaving a down market.

- Numerous mutual funds in India have unique SIP plans of their lead funds for retail investors.

- This SIP instrument encourages you normal the expense of shares or mutual fund unit that you buy occasionally.

- Taste subsequently goes about as a programmed market timing instrument.

- Taste constrains you to purchase more units (you are purchasing greater amount for the same measure of cash) when the cost is down and fewer units (you are purchasing less amount for the same measure of cash) when the cost is up.

- Through this system you can't yet help decrease your normal expense of procurement of shares or mutual fund units over its highs and lows, accordingly frequently improving the returns from your investments.

- As obvious, SIP is really a more intelligent method for investing.

- The basic thought of SIP is basic. On the off chance that the investment vehicle picked for actualizing this strategy is a well-broadened value fund or a listed fund, the development of the portfolio esteem will co-identify with the development of the more extensive stock market.

So how to pick the privilege mutual fund that is putting forth the SIP?

Size of Sponsor: In Real investing we are discussing time allotments of not three to five years but rather 50 years! So the backer of the SIP must be a substantial and presumed association that can be relied upon to be near, without going bankrupt, for the following 50 years. UTI, SBI, HDFC are a couple of instances of such supporting associations.

Expanded Index Funds: Please don't escape by extravagant sectoral funds like 'Pharma', 'Auto' etcetera, and go for a plan proposing to invest the funds in a broadened, list fund, for instance, BSE S&P 500 file fund.

Fund Management Charges: Kindly focus on the charges collected for fund management. There are charges like 'Section Load', 'Leave Load' and 'Yearly Fund Management Fee'. These normally go from 1– 3%.which are excessive, taking into account that after around 30 years your investment would have developed to a couple of crores (10 million is 1 crore) rupees. They ought to be the least. So among the short recorded funds dependent on over two criteria, pick the plan that charges most minimal expenses.

Best SIP Plans for High Growth in the Long Term

- Mirae Asset Large Cap Fund - Direct - Growth

- Mirae Asset Emerging Bluechip Fund - Direct - Growth

- HDFC Small Cap Fund - Direct - Growth

- L&T Emerging Businesses Fund - Direct - Growth

- Axis Midcap Fund – Direct – Growth

- L&T Midcap Fund

- Aditya Birla Sun Life Equity Fund-Direct

- Axis Bluechip Fund

SIP implies Systematic Investment Planning. It enables you to invest deliberately i.e week after week, month to month or quarterly dependent on your inclination. Presently the question emerges invest where? With the assistance of SIPs, you are investing in Mutual Funds. So at the end of the day, SIP is an instrument by which you can invest in Mutual Funds. Another device is a Lump Sum amount invested in mutual funds.

SIP investments are a restrained type of investing where you are actually compelled to spare each month. Here, findings are made consequently from your financial balance into the picked value mutual fund investment, on a particular date for a particular period. In this technique for investing, you will invest in the markets amid larger amounts just as lower levels, and subsequently, you will get a weighted normal return over some undefined time frame.

A lumpsum investment is done when the whole sum in invested at one go into a picked value mutual fund. Lumpsum investing techniques are for the most part done by progressively instructed investors who have a superior comprehension of the markets and current valuations or investors with the financial counselor who comprehends value market conduct.

when to utilize these two systems

Lumpsum investments procure the best outcomes when done as pursues:

- when valuations of the shares and markets are low.

- when markets P/Es and explicit stock P/Es are low.

Blend of lumpsum investments done amid the lower dimensions of market alongside SIP investing is certain to give a sound weighted normal XIRR return over a 3-multi year time span. This can be executed just on the off chance that you have severe control, are all around educated about the markets and don't freeze.

Obviously, it is difficult to invest precisely at the base of the market. The way to fruitful investing is in reality extremely basic - purchase modest and sell high and furthermore be taught about investing.