How did Rajeev turn 22 thousand into approx 20 lacs in just 10 months?

We all get that one unintended chance to make fortune at least once in our lifetime, Don’t you agree? Waiting for the break and getting into action once you recognise that chance is what’s best in this world. History has repeated itself many times and it will on keep on doing that. Why are we telling you all this? Well, Today we are talking about investment & trading in stock market decision which turned out to be so good for Rajeev.

In 2017, Every equity stocks were ready to set up a new record but weren’t just ready yet. Many investors were searching the market for right investment but couldn’t find any in Indian Stock Market. Except there was one thing which was really HOT at the beginning of 2017. You guessed it! Cryptocurrencies. Yes, We are coming on that now.

What is cryptocurrency?

According to Wikipedia, a digital currency in which encryption techniques are used to regulate the generation of units of currency and verify the transfer of funds, operating independently of a central bank.

Without making it too complicated

Cryptocurrency is sort of currency which runs on a platform called blockchain, and it is limited and mineable. In total only 2crore 40 lacs Bitcoins can be mined. It is used to transfer money from one location to another without involving Banks and government.

In 2017, Cryptocurrencies were on fire, like a hot selling cake. Every investor wanted to get a pie of the cake and so did Rajeev. Rajeev is a college graduated, completed his graduation in 2015. He was keen to know more about Trading and investing in the stock market. He started trading when he was 18.

Most of his trades were unsuccessful, but he still managed to make money from the stock market. He aimed to make money from the stock market without having to invest too much or with little risk. News introduced him to cryptocurrencies and that grabbed his attention. Bitcoin was skyrocketing every single day and was so expensive to afford. Rajeev had only 22,000 so he checked for the second best currency, that when he got to know about Ethereum.

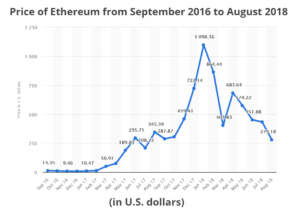

Ethereum is similar to bitcoin but was less in cost. Here is the chart of Ethereum.

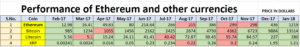

He decided to invest his money in Ethereum. He got an entry at $13 dollars which was approx. Rs 884 on Feb 19, 2017. He got 24.88 Ethereums which he transferred in his cold wallet. There were ups and down in his way up to the top but Ethereum performed really well during that year. Here is the table of the performance of Ethereum and 3 other currencies for your reference.

Ethereum price skyrocketed during that year, In Jan, the price was $1219 approx rs 82,892. Since Rajeev bout 24 Ethereums, His total earnings from that single currency was Rs 2,062,352.

Now, this was an amazing thing clearly, getting 9737% of growth in 10 months was unexpected.

Now we are not saying you get this opportunity every day or month, but it is something you can always look for.

Thank for reading this post.

BONUS Q&A

-

Will cryptocurrencies go up again?

According to some known investors and celebs, it might touch $50,000 in 2020. But some names beg to differ and suggest it is nothing but a fairy tale. We do not know which side to chose but here are some pros and cons which can help you decide whether to invest in cryptocurrencies or not

Let’s discuss the cons first

- Consumption of electricity in mining bitcoin is so high, according to news, it is almost as much as a tier 3 country total electricity consumption.

- Price is not stable and hardly will ever be. Unless bitcoin gets in every hand, the price of one bitcoin will remain highly volatile, which means it would be difficult of it to be used as regular currency.

- As far as blockchain is concerned, Many countries are interested in adopting the technology in their system, but might not accept bitcoin as the medium of exchanging goods.

- Banks are so strong right now in the market. Bringing bitcoin in the market will directly mean removing the banking system, which we hardly believe is gonna happen.

- It is directly related to technology, Considering few countries are very low in literacy lat and below the poverty line, in other terms, it may be difficult to use bitcoin as a universally accepted currency.

The pros

- You can send money all around the world with one click. Just need to pay very little fees.

- Easily carriable and totally private.

- Highly volatile which means it can be traded for profit.

- And so more.

Let us know how do you feel about bitcoin? Do you think one should consider investing?