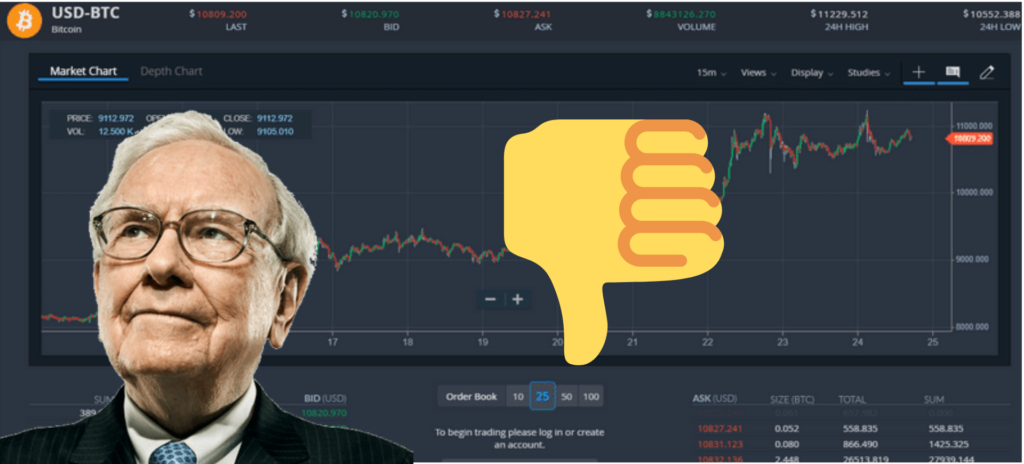

Should I buy bitcoin? Is this the right time to invest? What Warren Buffet has to say

With regards to bitcoin, tycoon investor Warren Buffett needs to make one thing obvious: Unlike purchasing stocks, bonds or land, purchasing bitcoin isn’t an investment.

That is on the grounds that it needs characteristic worth, Buffett says.

“On the off chance that you purchase something like bitcoin or some cryptographic money, you don’t have whatever is delivering anything,” Buffett says in a meeting with Yahoo Finance. “You’re simply trusting the following person pays more. Furthermore, you just feel you’ll locate the following person to pay more on the off chance that he supposes he’s going to discover somebody that is going to pay more.

“You aren’t investing when you do that, you’re hypothesizing.”

Celebrated for his “purchase and hold ” investment procedure, the Berkshire Hathaway CEO fabricated his organization — and his $82.8 billion total assets — backing organizations that have substantive worth.

“Set up together a portfolio of organizations whose total profit walk upward throughout the years, thus likewise will the portfolio’s market esteem,” Buffett wrote in his 1996 letter to shareholders. “In the event that you aren’t willing to possess a stock for a long time, don’t consider owning it for ten minutes.”

To be an investment, what you’re purchasing must merit something all alone, Buffett says.

For instance, “One day that you purchase something [like] a ranch, a condo or an enthusiasm for a business and look to the asset itself to determine whether you’ve accomplished something — what the homestead produces, what the business acquires … it’s a consummately palatable investment,” Buffett discloses to Yahoo Finance. “You take a gander at the investment itself to convey the return to you.

“In the event that you boycott trading in ranches, you could in any case purchase cultivates, and have a consummately tolerable investment,” Buffett says.

Bitcoin, in any case, just increments in an incentive by being purchased and sold, he contends. Its worth originates from what individuals are eager to pay.

“[I]f you boycott trading in … Bitcoin, which no one knows precisely what it is, individuals would state, ‘Well why on the planet would I get it?'”

The Oracle of Omaha has held this supposition since at any rate 2014, when he told CNBC of digital forms of money, “It’s an illusion basically.”

“The possibility that it has some immense inherent worth is only a joke in my view,” Buffett said.

In 2017, bitcoin took off from beneath $1,000 toward the beginning of the year to over $19,000 in December, grabbing the eye of everybody from J.P. Morgan Chase CEO Jamie Dimon to NFL players. Tuesday, bitcoin traded close $8,900 as per CoinDesk’s value list.

Buffett sees a depressing future for the advanced cash.

“In terms of cryptographic forms of money, for the most part, I can say with nearly sureness that they will reach an awful completion, ” Buffett told CNBC in January. “When it occurs or how or whatever else, I don’t have a clue.”

Obviously, Buffett has been off-base about support new advances previously. He botched chances to invest in Google and Amazon, choices he currently calls botches.

“I didn’t think [founder Jeff Bezos] could prevail on the scale he has,” Buffett said to shareholders in May 2017.

Crypto-lovers contend that Buffet doesn’t comprehend blockchain-based coins, and he has conceded to such an extent.

In any case, numerous other investing specialists like CNBC’s Jim Cramer, Kevin O’Leary, and Tony Robbins, additionally consider purchasing digital forms of money a bet. They propose considering it like rolling the shakers in Las Vegas.

“For whatever length of time that you can bear to lose all that you put into it, go with it,” O’Leary disclosed to CNBC Make It in December, 2017.

That attitude approves of Buffett.

“There’s nothing amiss with it on the off chance that you need to bet [that] another person will tag along and pay you more cash tomorrow,” Buffett reveals to Yahoo Finance. “That is one sort of game. That isn’t investing.”

“Bitcoin has no one of a kind incentive by any stretch of the imagination. It doesn’t deliver anything. You can gaze at it throughout the day and no little bitcoins turn out. It’s a dream basically.”